Discover the difference of personalised support with us.

A Better Home Begins With A Better Loan.

Discover the difference of personalised support with us.

We’ve partnered with 60+ lenders so we can find the one that’s right for you.

Our loan processes are so streamlined and customer centric that we make your experience a memorable one.

We work for you, not for the banks.

We are available throughout to answer all your financial queries.

We understand that the journey to homeownership is a significant step in life. Our home loan services are designed to make this process seamless, transparent, and tailored to your unique needs.

Experience tailored financing solutions and specialised guidance from Alloans to fuel your commercial aspirations. Our dedicated financial support is designed to propel your business forward confidently.

Experience seamless construction funding with Alloans, where your aspirations take shape, brick by brick, guided by our dedicated team. Our tailored solutions redefine construction financing.

Our specialists are here to assist in creating financial loans to support your business goals and drive growth, making asset acquisition smooth and effortless, so you can move confidently toward success.

The Melbourne property market is vast and ever-changing, making it quite challenging to find the right finance brokerage solutions to secure your dream home, investment property, or even that new car. That’s where Alloans comes in – the leading finance Alloans broker in Melbourne.

Whether you’re a first-time home buyer looking for competitive interest rates or a property investor seeking to expand your portfolio in the Melbourne market, our finance Alloans brokers have the expertise and resources to help you find the perfect solution for your financial needs. We will walk you through every step of the Alloans process, explaining the process and ensuring you fully understand what you’re getting into.

Our dedicated finance Alloans broker doesn’t offer a one-size-fits-all approach for Melbourne locales. We offer a range of finance Alloans services, including:

Partnering with our Alloans broker in Melbourne for your finance needs comes with a wealth of advantages:

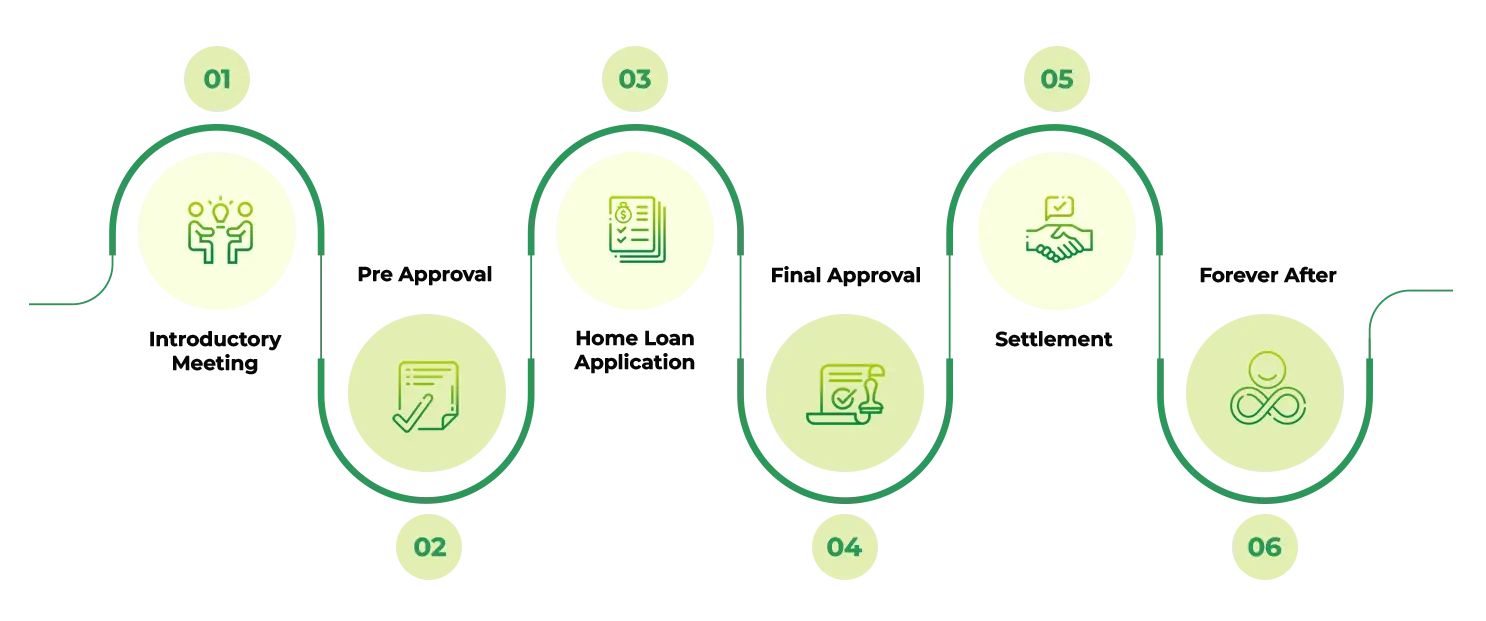

At Alloans, we believe in a transparent and streamlined process. Our streamlined 6-step process ensures that you’re guided through every stage with ease and confidence:

1. Initial Consultation:

We begin by scheduling an initial consultation where we get to know you, your financial goals, and your unique circumstances. This is your opportunity to ask questions, share your concerns, and outline your objectives.

2. Analysis and Recommendation:

Next, our experienced finance Alloans brokers thoroughly analyse your financial situation and requirements. Based on this assessment, we provide personalised recommendations tailored to your needs and goals.

3. Application Submission:

Once you’re ready to move forward, we handle the entire application process on your behalf. Our team takes care of all the paperwork, ensuring accuracy and efficiency throughout the submission process.

4. Negotiation and Approval:

With your application submitted, our specialised negotiators leverage their industry expertise to secure the best possible terms from our network of lenders. We advocate on your behalf to ensure a favourable outcome and expedite the approval process.

5. Documentation and Settlement:

As your application progresses, we will assist you in gathering any additional documentation the lender requires. We guide you through the settlement process, ensuring that all necessary paperwork is completed accurately and efficiently.

6. Ongoing Support:

Even after settlement, our commitment to your success doesn’t end. We provide ongoing support and guidance, monitoring your Alloans and financial situation to ensure that your needs continue to be met as they evolve over time.

Melbourne is a vibrant city, and your finance Alloans broker should be just as dynamic. We offer:

Contact our finance Alloans broker for a free consultation in Melbourne and see for yourself how we can help you achieve them.

The documents required will vary depending on the loan type. Generally, you will need proof of income, identification documents, and bank statements. We will provide a detailed list during your consultation.

We understand that credit situations can be complex. We will work with you to understand your situation and explore loan options that may still be available.

The timeframe can vary depending on the loan type and your circumstances. We will provide an estimated timeline during the consultation process and keep you updated throughout the application.

Yes, we offer loans for self-employed individuals. As part of the application process, you will need to provide proof of income and tax documents.